8 eInvoicing Profiles (Normative)

This section defines the Profiles of the Data Formats to be used for XML Document exchanges as part of the eInvoicing process.

Following from the eInvoicing Semantic Model (Digital Business Council, 2016c) the eInvoicing Profiles has been defined to include only the essential UBL Elements (the Core) that an eInvoicing Document needs to satisfy operational, financial and regulatory (e.g. GST) requirements.

Core UBL Elements are those that business applications or Service Interfaces must be able to recognise if they appear in a Document. Not all Core UBL Elements need appear in all eInvoice Documents, these are noted as Optional in the Profile. Core UBL Elements noted as Mandatory in the Profile and must appear in every eInvoice Document.

Using these Core UBL Elements for eInvoices means that businesses are able to:

a. Interpret and understand the meaning of the common, essential information on an eInvoice; and

b. Inform their software or Service providers to process these Core UBL Elements based on the eInvoicing Semantic Model (Digital Business Council, 2016c).

These Profiles are a conformant subset of the OASIS Universal Business Language (UBL) v2.1 (ISO/IEC 19845:2015) (OASIS UBL TC, 2013). XML Documents conforming to these Profiles also conform to the UBL standard.

8.1 Document Constraints

All XML Documents must conform the UBL rules for Document constraints (OASIS UBL TC, 2013). Specifically:

[IND5] UBL conformant instance documents MUST NOT contain an element devoid of content or containing null values, except in the case of extension, where the UBL Extension Content element is used.

This means that a Mandatory UBL Element must not be empty. If they appear in an XML Document, Optional Elements must also not be empty.

And:

[IND2] All UBL instance documents MUST identify their character encoding within the XML declaration.

[IND3] In conformance with ISO IEC ITU UN/CEFACT eBusiness Memorandum of Understanding Management Group (MOUMG) Resolution 01/08 (MOU/MG01n83) as agreed to by OASIS, all UBL SHOULD be expressed using UTF-8.

8.2 Diagram Notation

The remainder of this section provides a description of the UBL Elements within the eInvoice Schemas.

The diagramming notation used has the following key:

- Mandatory Element

- Optional Element

Examples of the use of these Elements are also provided.

In addition, a tabular version of the mapping between the eInvoicing Semantic Model and UBL is provided in Annex B of the eInvoicing Semantic Model (Digital Business Council, 2016c) and also in the tables available at:

http://resources.digitalbusinesscouncil.com.au/dbc/documents/core-invoice/summary/core-invoice-01.html

8.3 Core Invoice XML Schema

The Core Invoice Schema is used for defining the following eInvoicing Document types:

• Invoice;

• Recipient Created Tax Invoice (RCTI), and;

• Credit Note.

The specific Document type is identified by the Value of the InvoiceTypeCode Element.

The remainder of this section walks through the various structures in the Core Invoice Schema.

The Response Document type is described in Section 8.4.

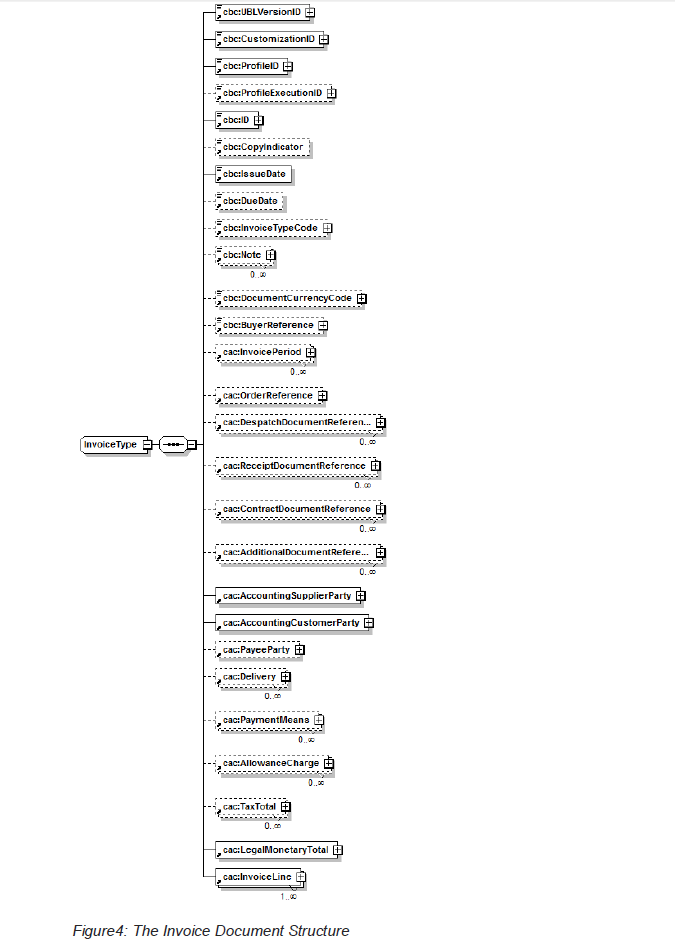

8.3.1 Invoice Document Type

The Invoice Element is the top level (often referred to as the root element) of the Invoice. The overall structure is describes in Figure 4.

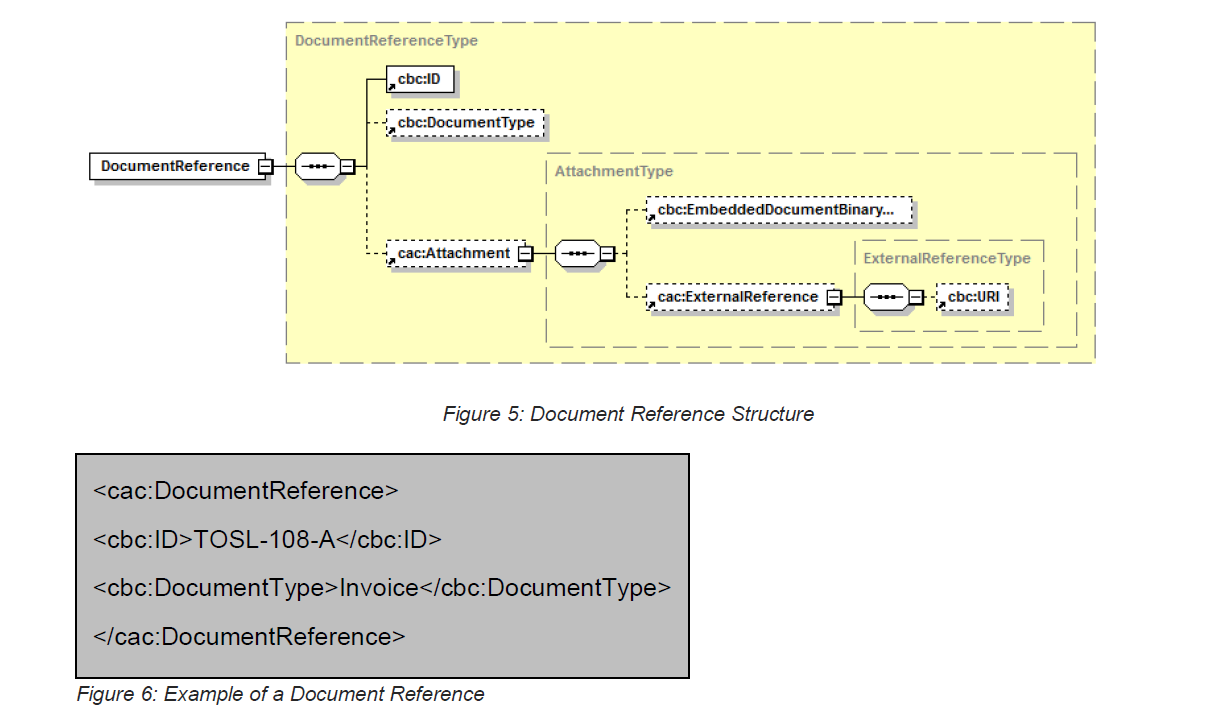

8.3.2 Document Reference Type

A Document Reference is a structure used to define a Reference to another Document.

The structure supports both Documents embedded or included with the Invoice and those referred to at an external URI.

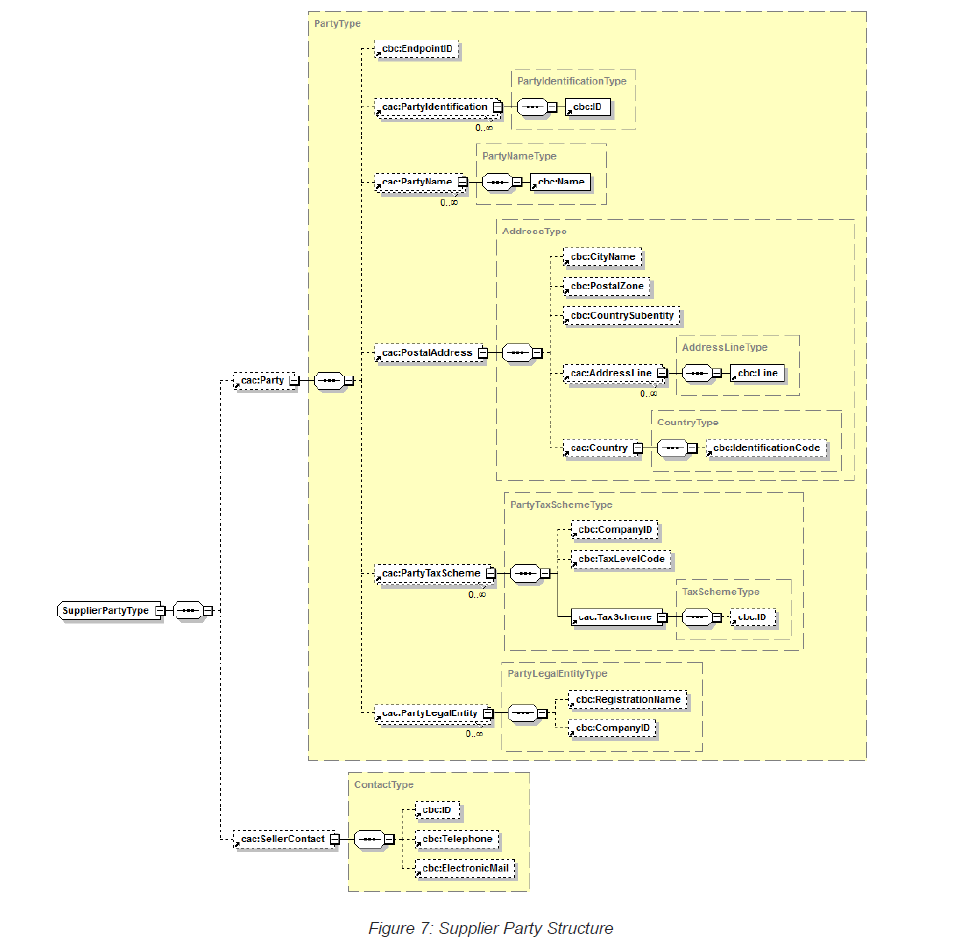

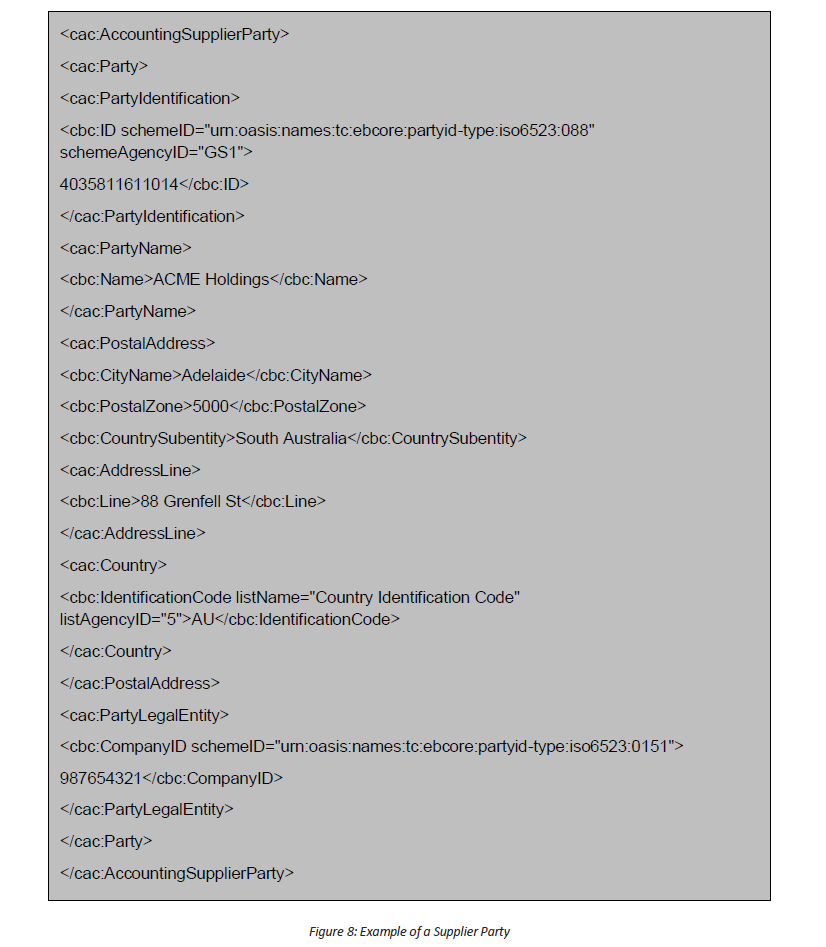

8.3.3 Supplier Party Type

Both Buyer and Supplier share the same Party structures.

Within the Core Invoice Schema the Supplier (who claims the payment and is responsible for resolving billing issues and arranging settlement) is identified using the UBL Element AccountingSupplierParty.

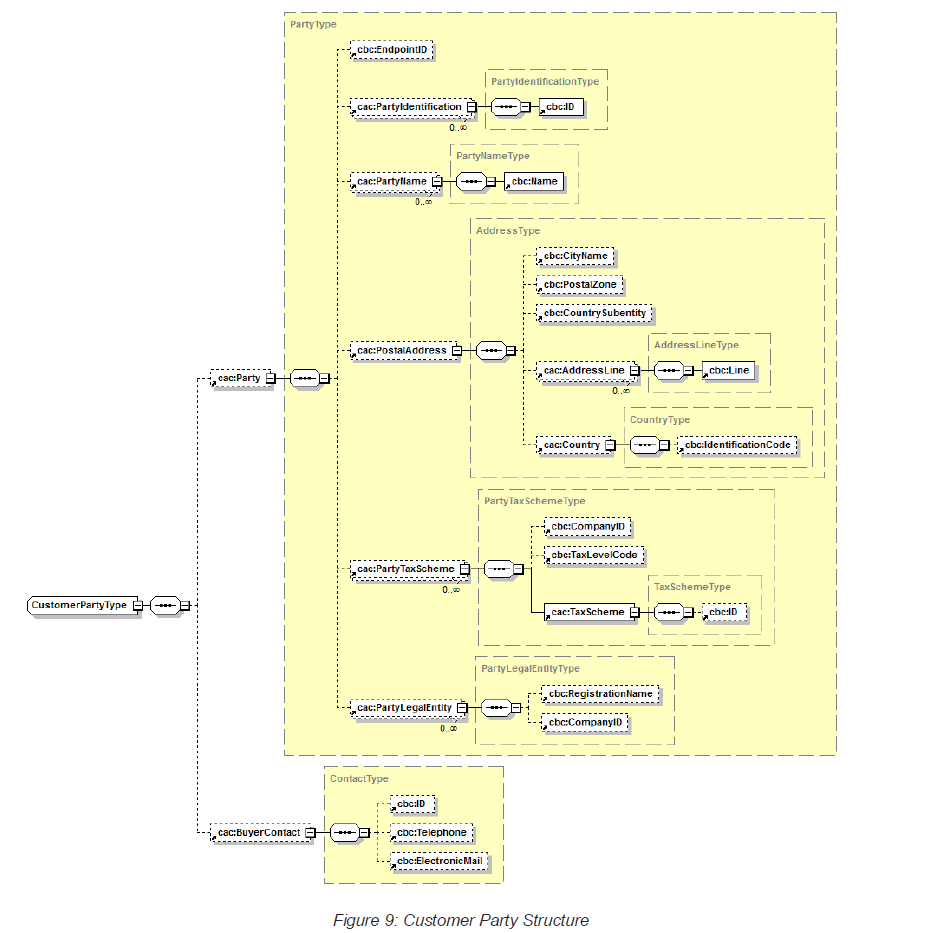

8.3.4 Buyer Party Type

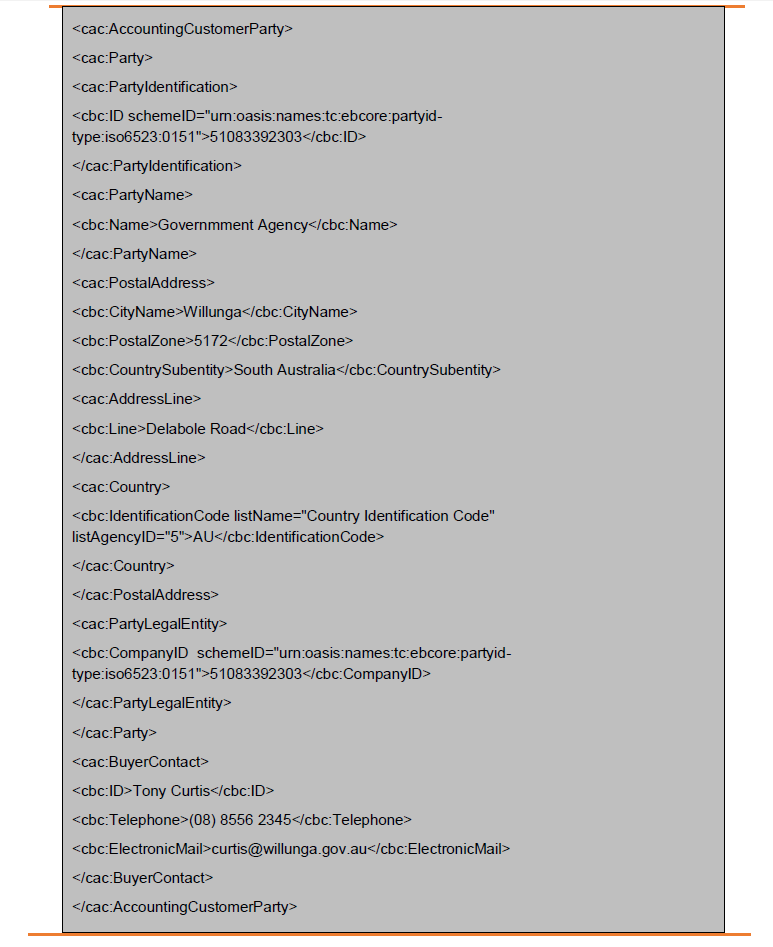

AccountingCustomerParty is the UBL Element used for identifying the Buyer (the Party making settlement relating to a purchase and resolving billing issues).

Figure 10: Example of a Customer Party

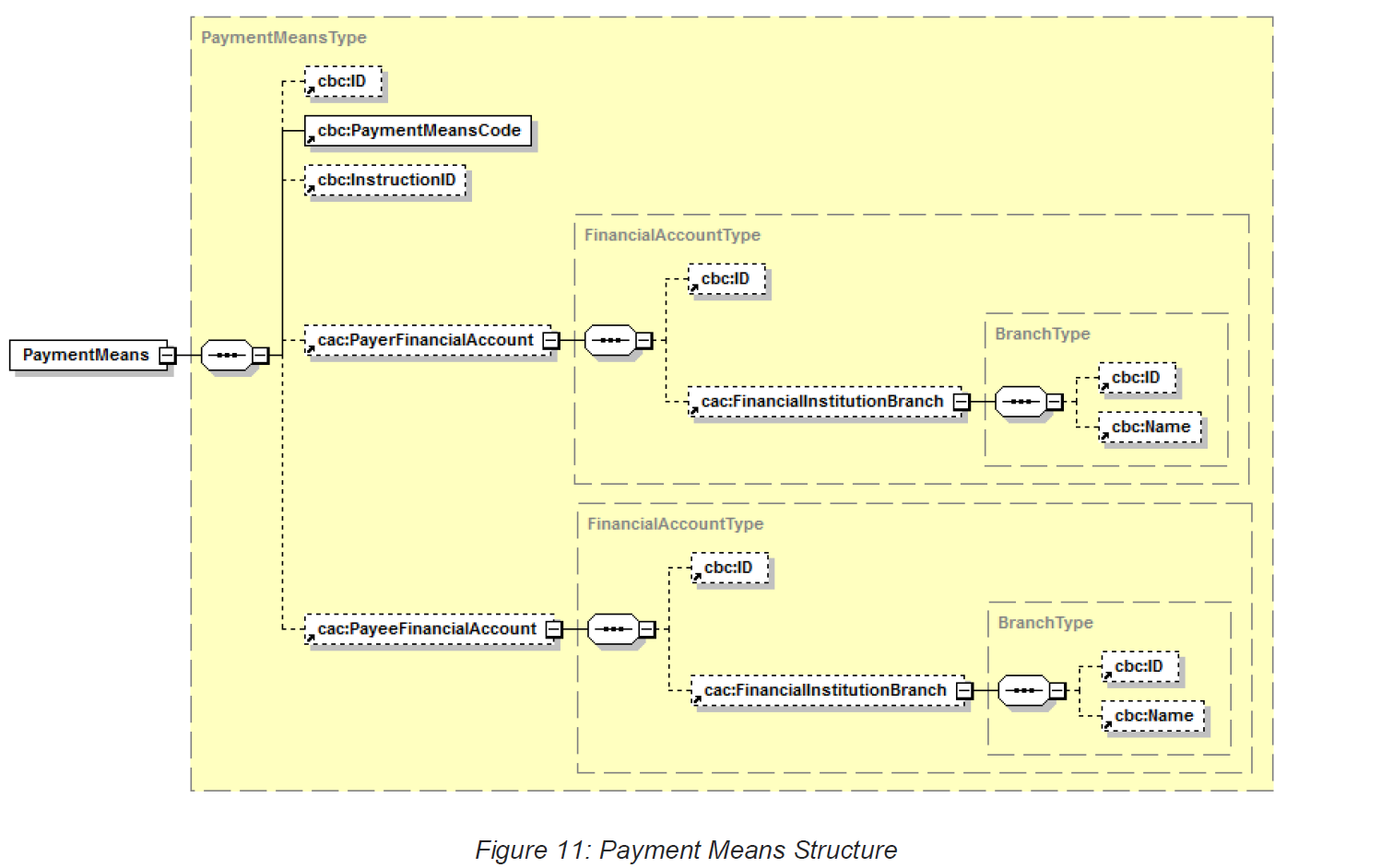

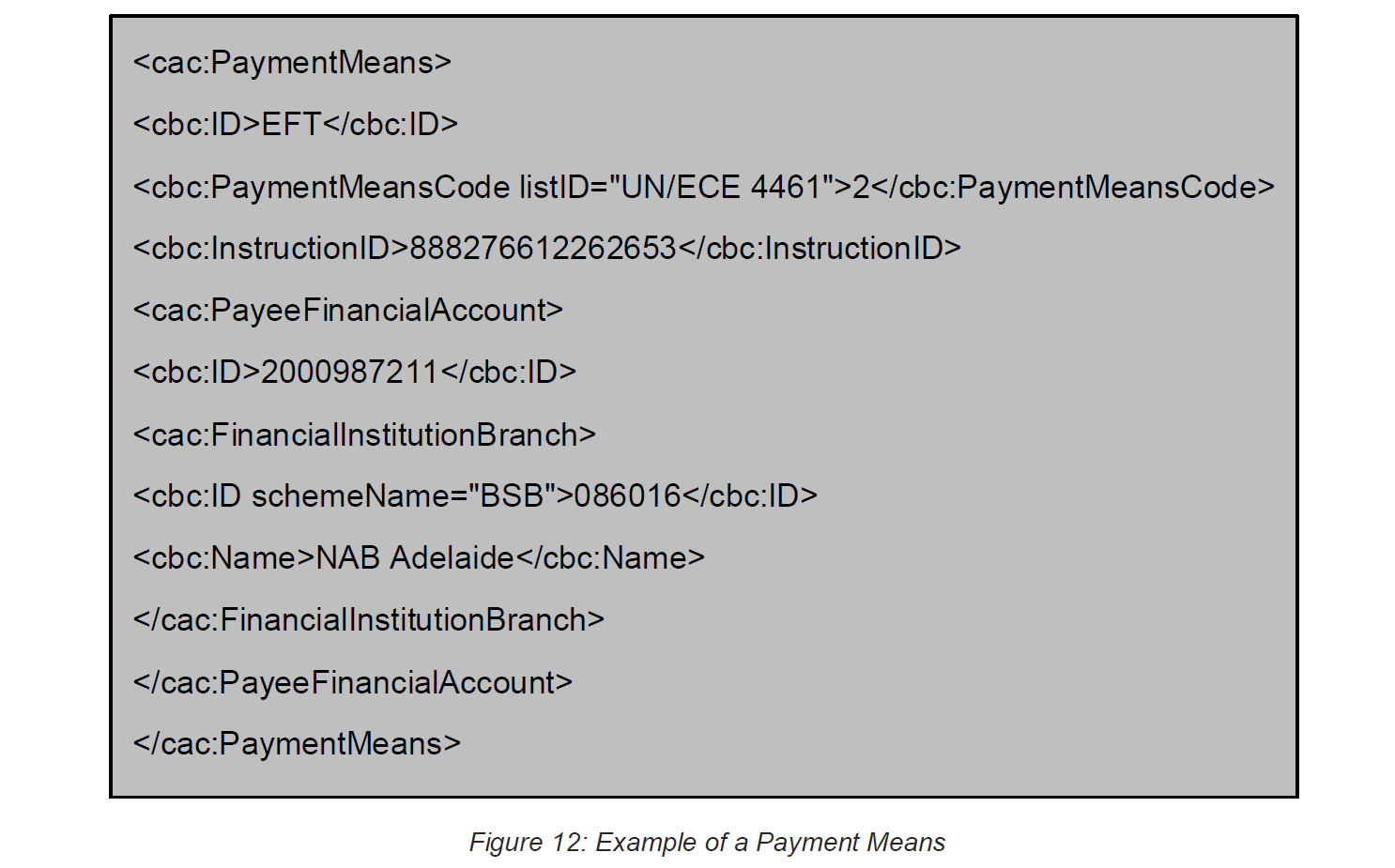

8.3.5 Payment Means Type

The Payment Means is the structure used to describe how payments are to be made.

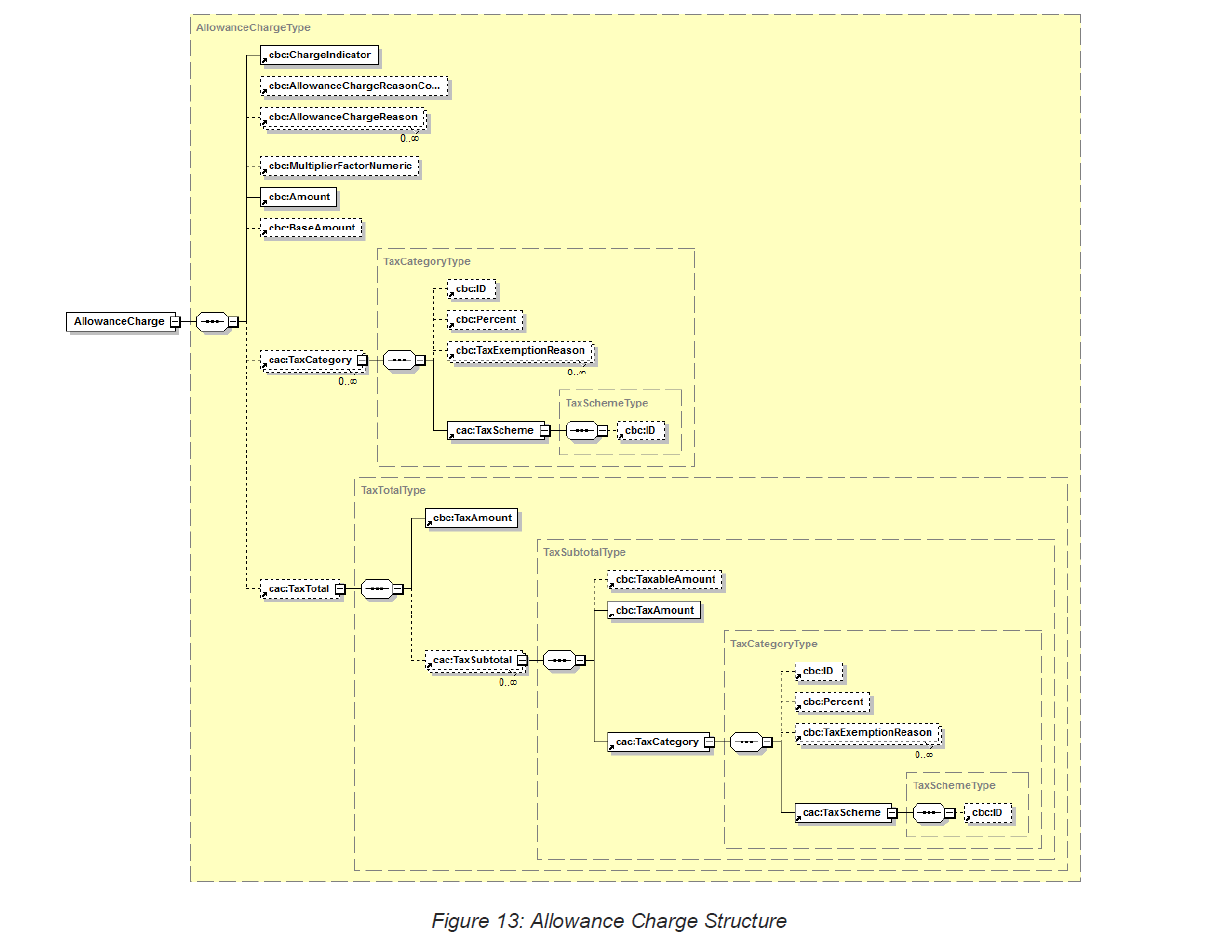

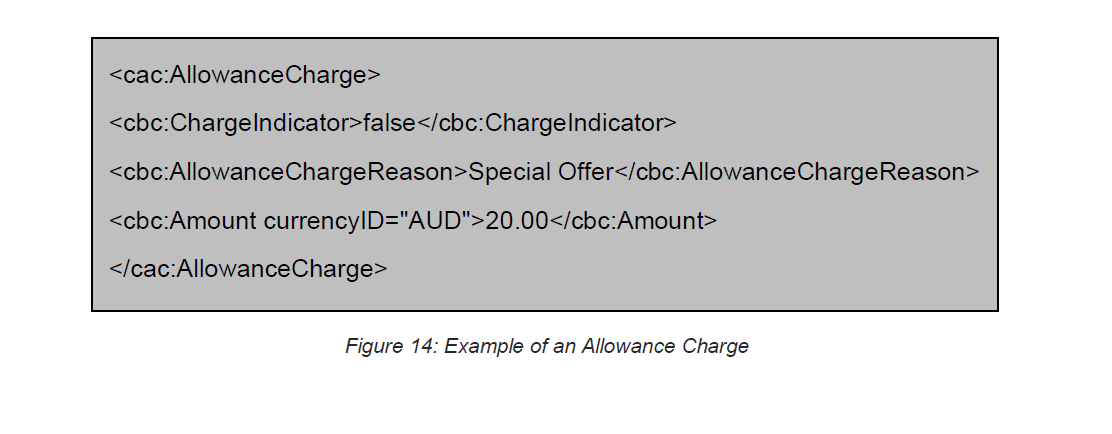

8.3.6 Allowance and Charges Type

Both Allowances (e.g. discounts) and Charges (e.g. penalties) are described by a common structure with an indicator (ChangeIndicator) to say whether this is a Charge (true) or an Allowance (false).

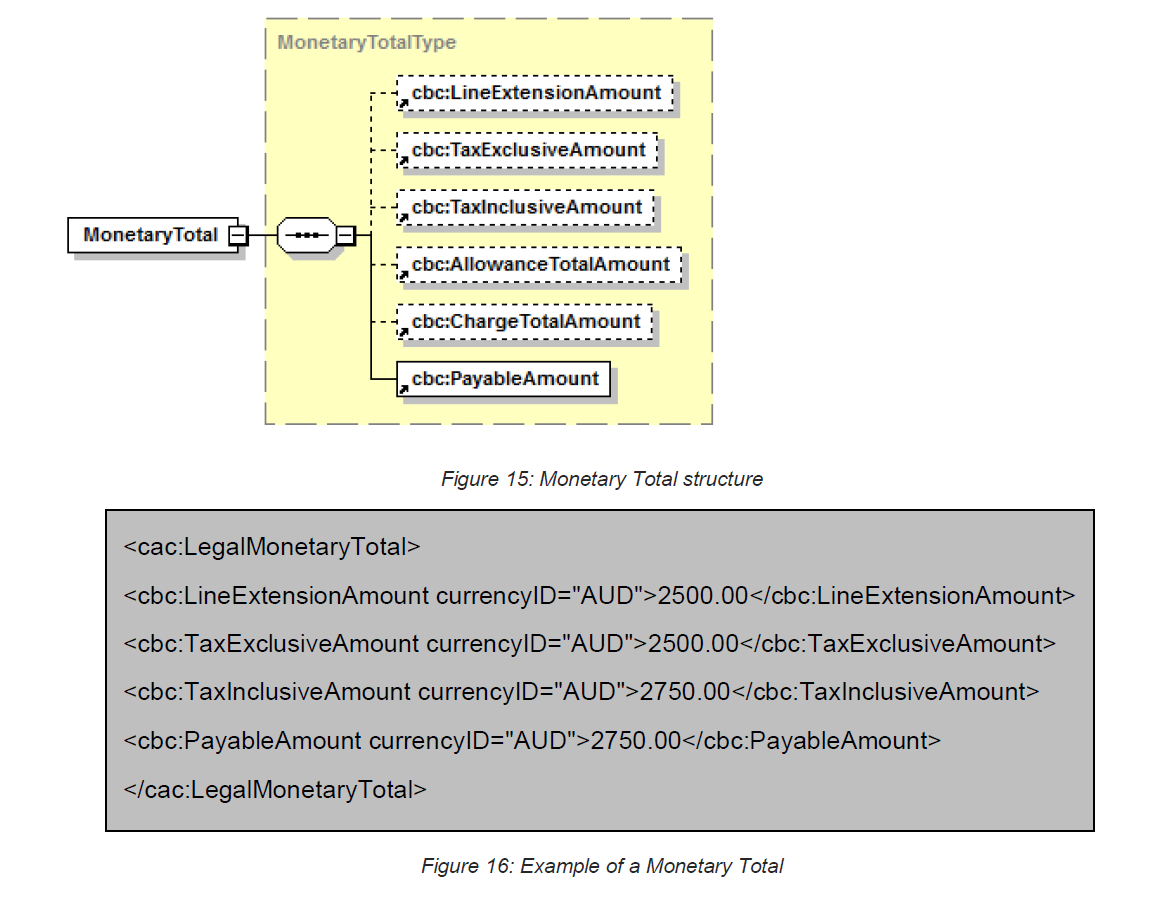

8.3.7 Monetary Total Type

The overall Amount to be paid for an eInvoice Document is described using a MonetaryTotal UBL Element.

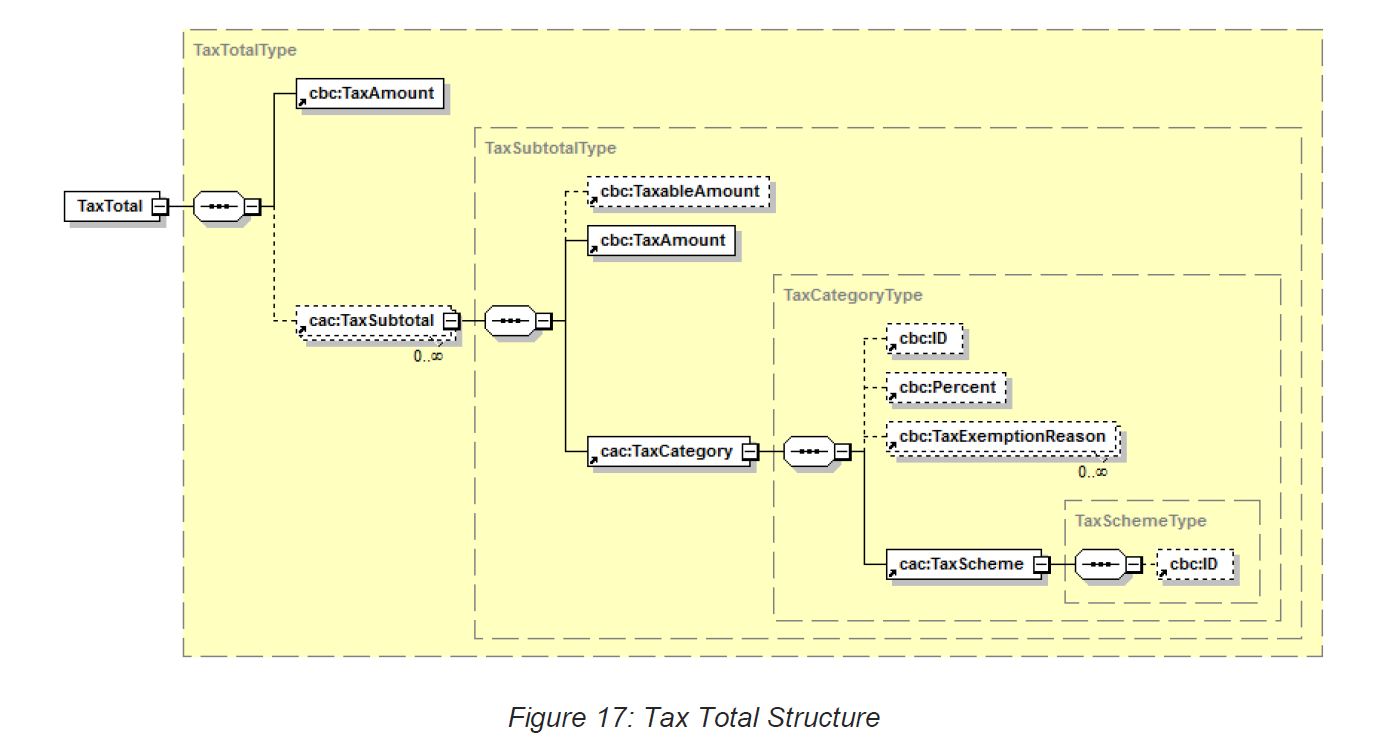

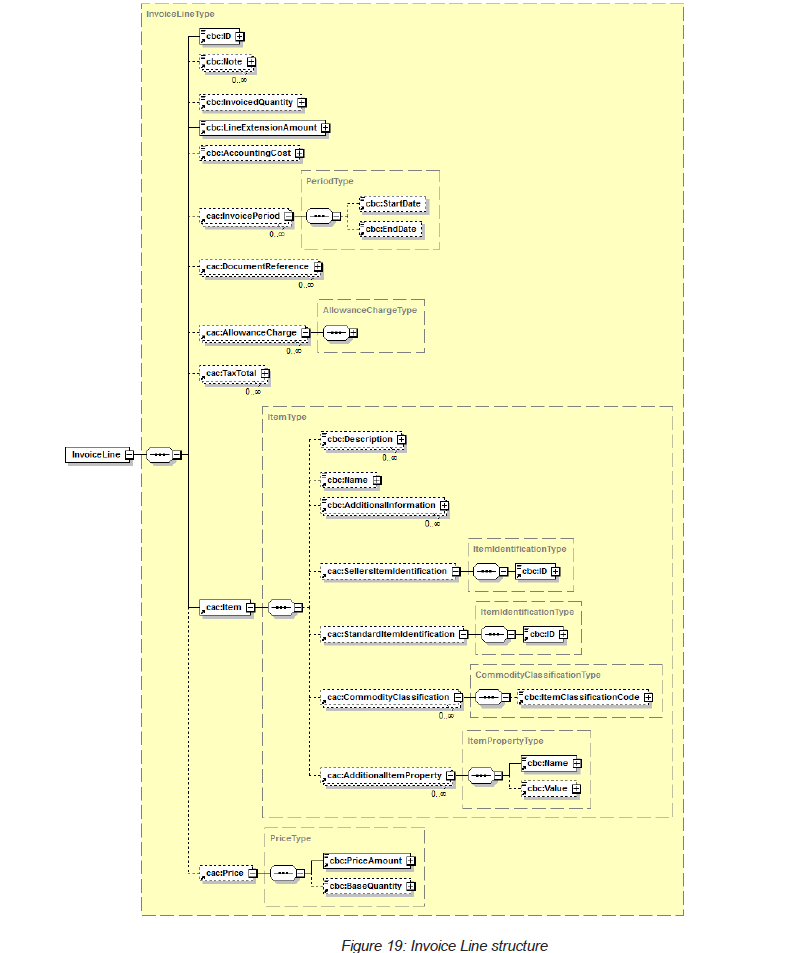

8.3.8 Tax Total Type

The overall Taxes involved are described using the Tax Total structure.

Multiple and mixed Tax Categories (for example, additional GST Categories) and their totals are supported.

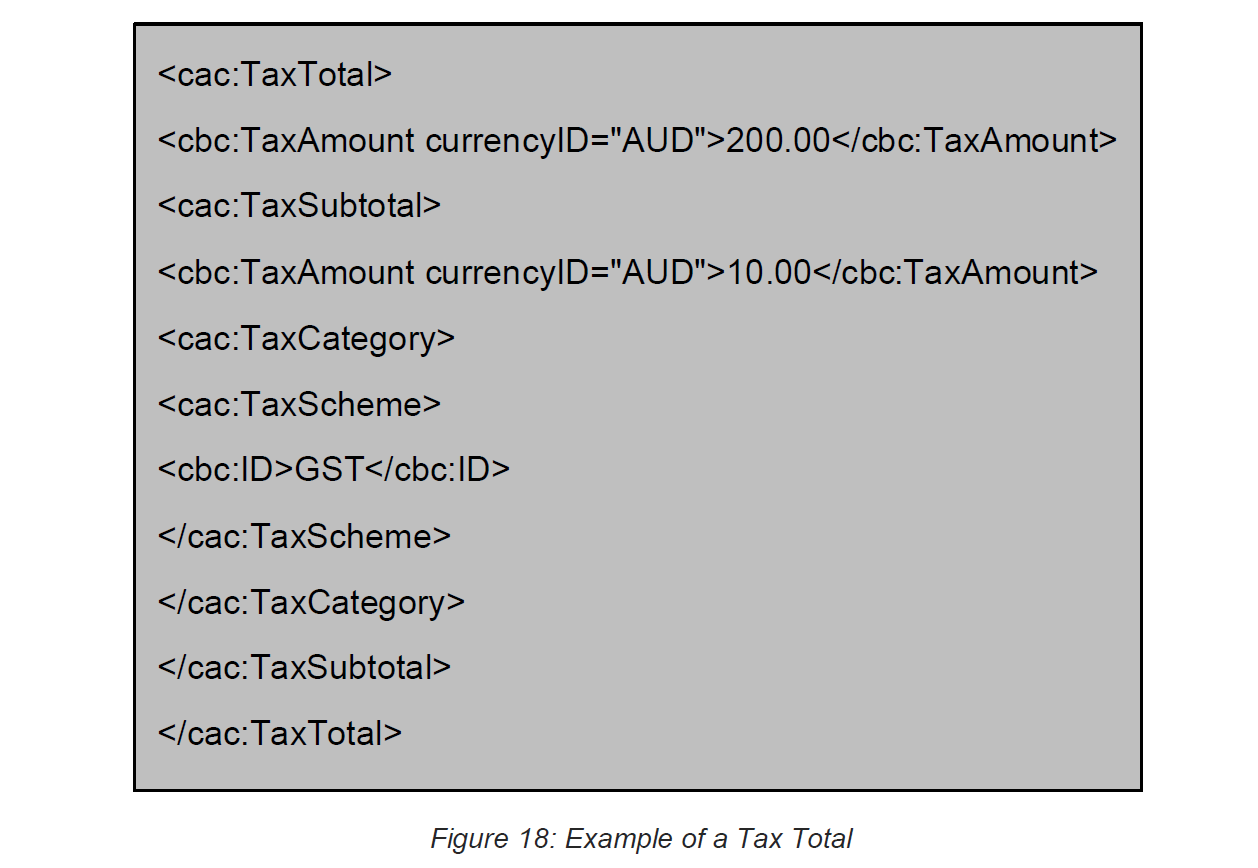

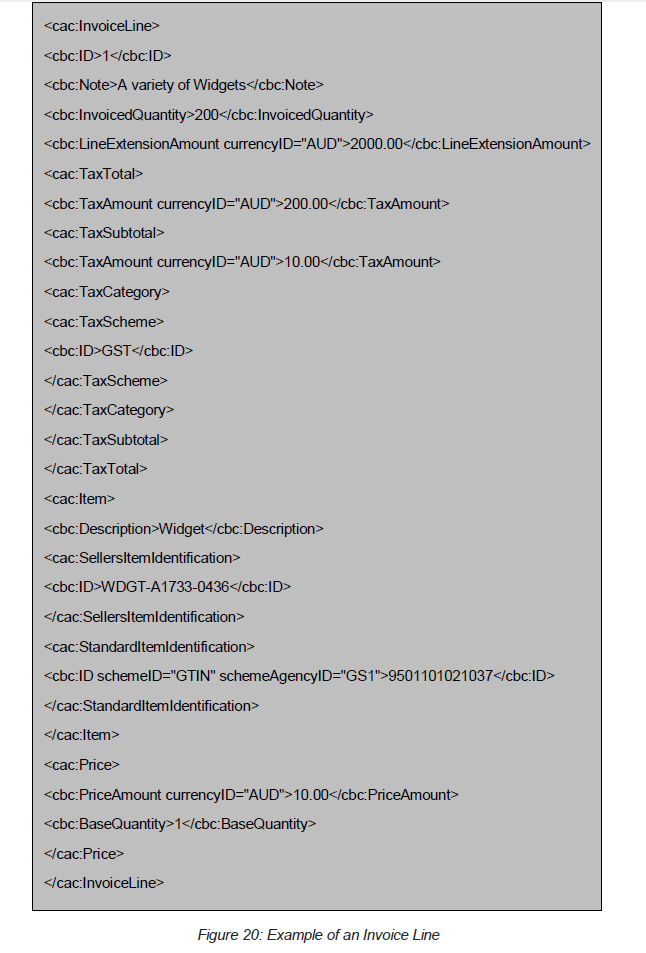

8.3.9 Invoice Line Type

Charges for individual Items or transactions are often described as ‘lines’ on an Invoice. The Invoice Line structure describes the attributes of an individual Invoiced Item.

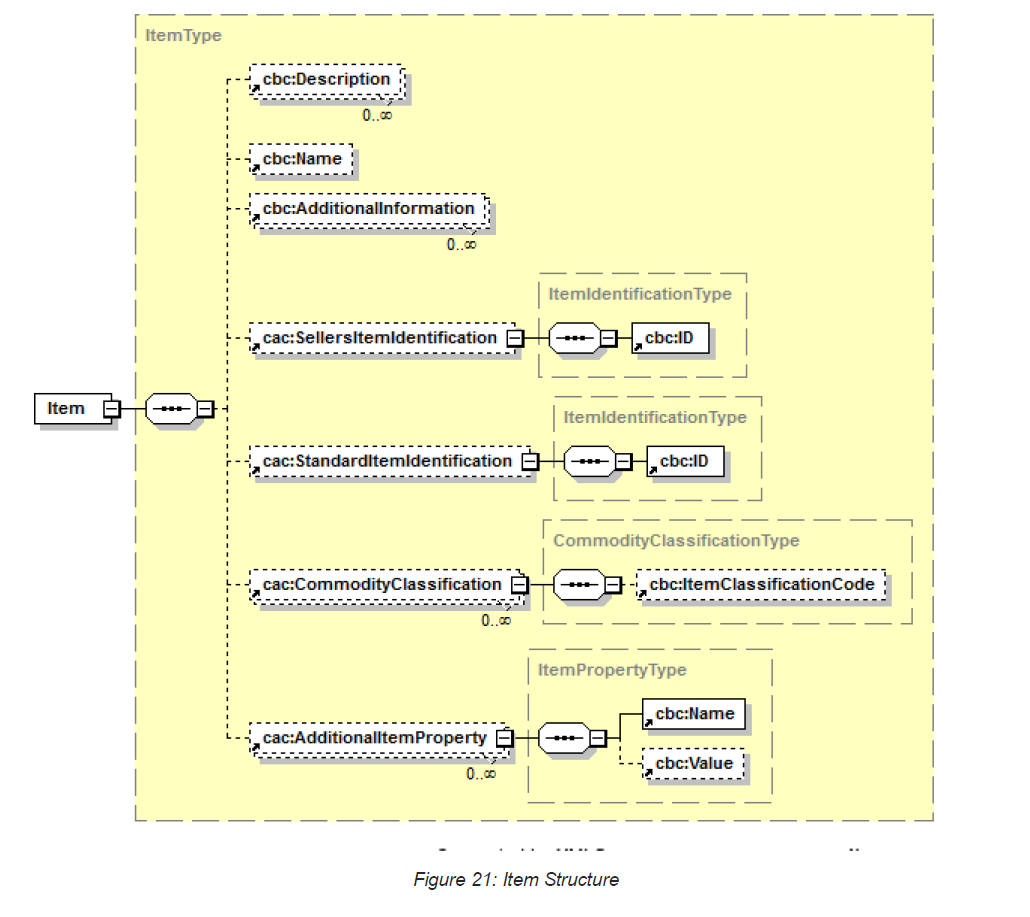

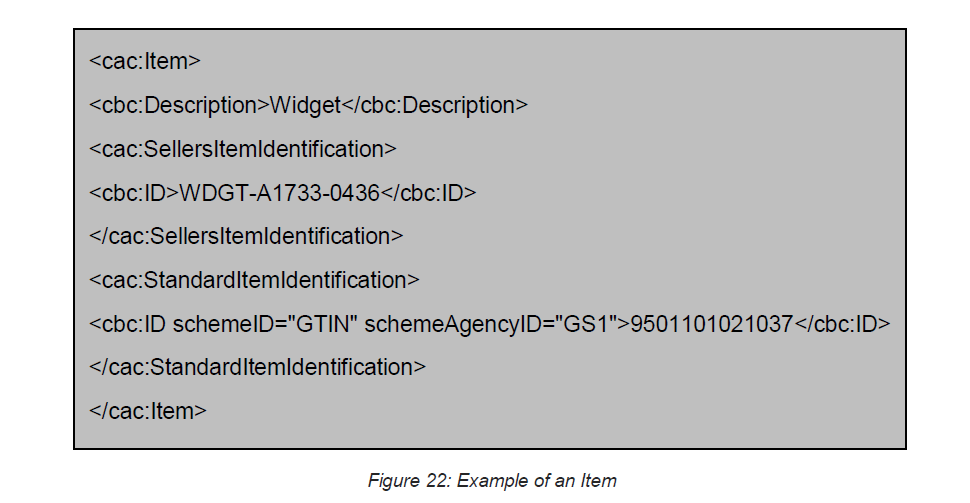

8.3.10 Item Type

The Item structure describes an Item of trade. It includes a generic Name and Description applicable to all examples of the Item together with various methods of uniquely identifying the Item.

Items can be identified and described by various (optional) Item Identification Schemes and Properties, and classified using various (optional) Item Classification schemes.

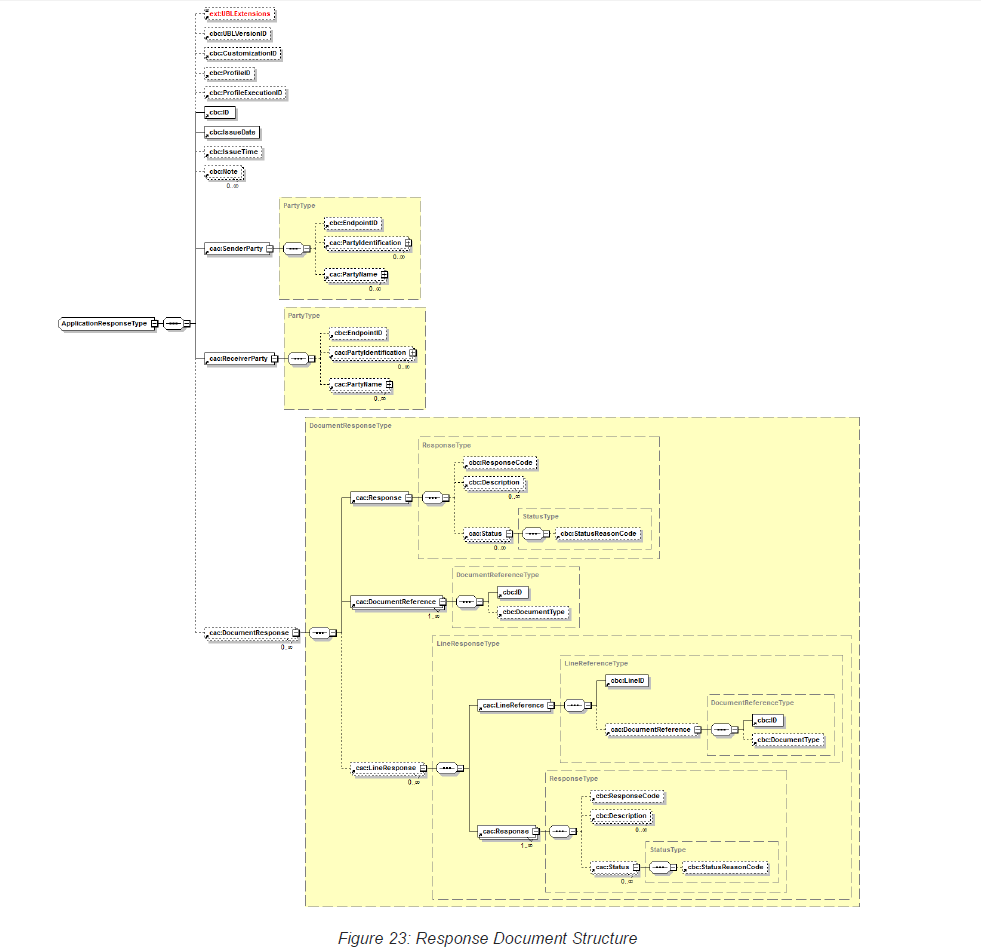

8.4 Response Document Schema

In an eInvoicing environment it is not uncommon for the recipient (either the Buyer or Supplier) to acknowledge the receipt of an eInvoice with a Response Document. This Response may also be used to specify the status of the transaction.

Using Responses is an opt-in system. Sending Response documents is at the discretion of the eInvoice recipient (typically the Buyer). Whether a Response Document is returned is based on the Invoice sender’s (typically the Supplier’s) registered capability to support that Service (see Section 10).

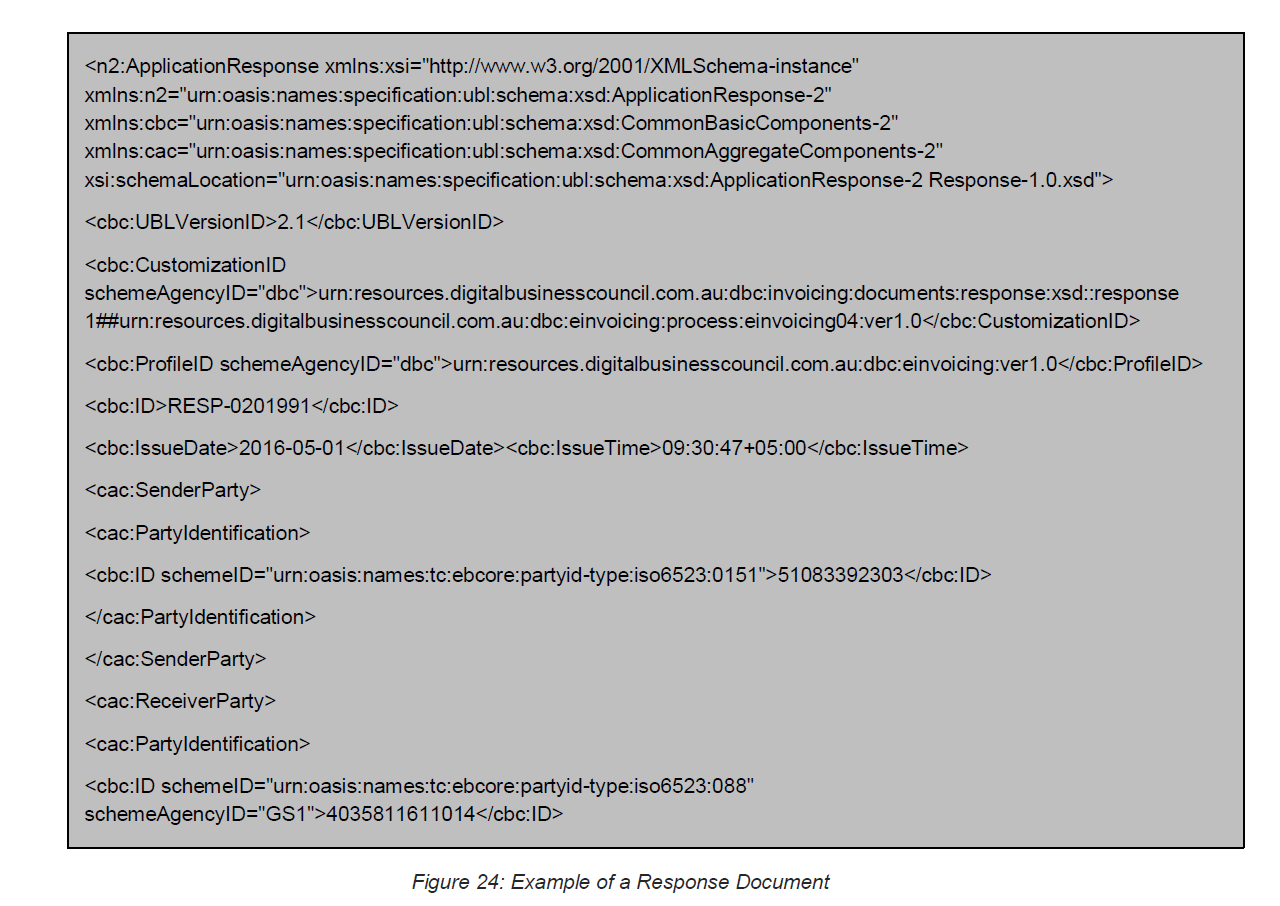

Figure 23 (below) describes the structure of the Response document and Figure 24 gives an example.

8.5 Data Types

All UBL XML Elements have an assigned Data Type taken from the UBL Unqualified Data Type set listed in Table 3 (OASIS UBL TC, 2013). Table 3 also indicates which XML Attributes must be used (mandatory) and which may be used (optional) with the UBL Elements of that Data Type.

Table3: Data Types for UBL Elements

| Data Type | Definition | Mandatory Attributes | Optional Attributes |

| AmountType | A number of monetary units specified using a given unit of Currency. | currencyID | currencyCodeListVersionID |

| BinaryObjectType | A set of finite-length sequences of binary octets. | mimeCode | Format, encodingCode, characterSetCode, uri, filename |

| CodeType | A character string (letters, figures, or symbols) that for brevity and/or language independence may be used to represent or replace a definitive Value or text of an attribute, together with relevant supplementary information. | listID, listAgencyID, listAgencyName, listName, listVersionID, name, languageID, listURI, listSchemeURI | |

| DateType | One calendar day according the Gregorian calendar. | xsd:date | |

| TimeType | An instance of time that occurs every day. | xsd:time | |

| IdentifierType | A character string to identify and uniquely distinguish one instance of an object in an Identification Scheme from all other objects in the same scheme, together with relevant supplementary information. | schemeID, schemeName, schemeAgencyID, schemeAgencyName, schemeVersionID, schemeDataURI, schemeURI | |

| IndicatorType | A list of two mutually exclusive Boolean Values that express the only possible states of a property. | format | |

| MeasureType | A numeric Value determined by measuring an object using a specified unit of measure. | unitCode | unitCodeListVersionID |

| NumericType | Numeric information that is assigned or is determined by calculation, counting, or sequencing. It does not require a unit of quantity or unit of measure. | format | |

| PercentType | Numeric information that is assigned or is determined by calculation, counting, or sequencing and is expressed as a percentage. It does not require a unit of quantity or unit of measure. | format | |

| RateType | A numeric expression of a rate that is assigned or is determined by calculation, counting, or sequencing. It does not require a unit of quantity or unit of measure. | format | |

| QuantityType | A counted number of non-monetary units, possibly including a fractional part. | unitCode, unitCodeListID, unitCodeListAgencyID, unitCodeListAgencyName | |

| TextType | A character string (i.e. a finite set of characters), generally in the form of words of a language. | languageID, languageLocaleID | |

| NameType | A character string that constitutes the distinctive designation of a person, place, thing, or concept. | languageID, languageLocaleID |