8 Business Processes

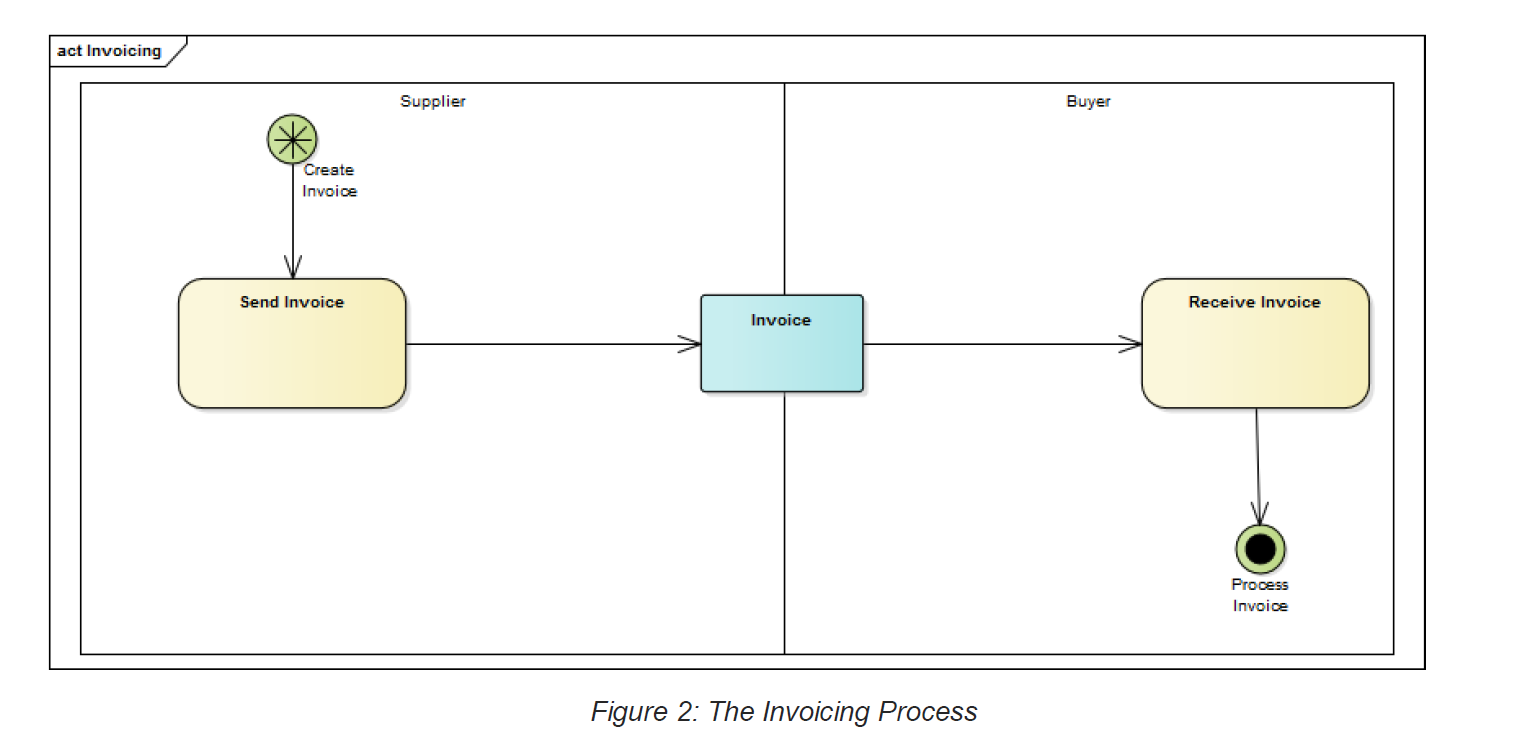

8.1 Invoicing

This represents the most common Invoicing process, where a Supplier (Accounts Receivable) issues an Invoice to a Buyer of goods or services (Accounts Payable).

An Invoice is a Document notifying an obligation to make a Payment, whereas a Tax Invoice is a Document that contains the information about a Taxable supply required by the Goods and Services Tax Act (1999) (Australian Government, 1999). The eInvoicing Semantic Model caters for the requirements of a Tax Invoice. References to Invoice should be assumed to encompass the Tax Invoice.

Figure 2 describes the flow of the Invoicing process.

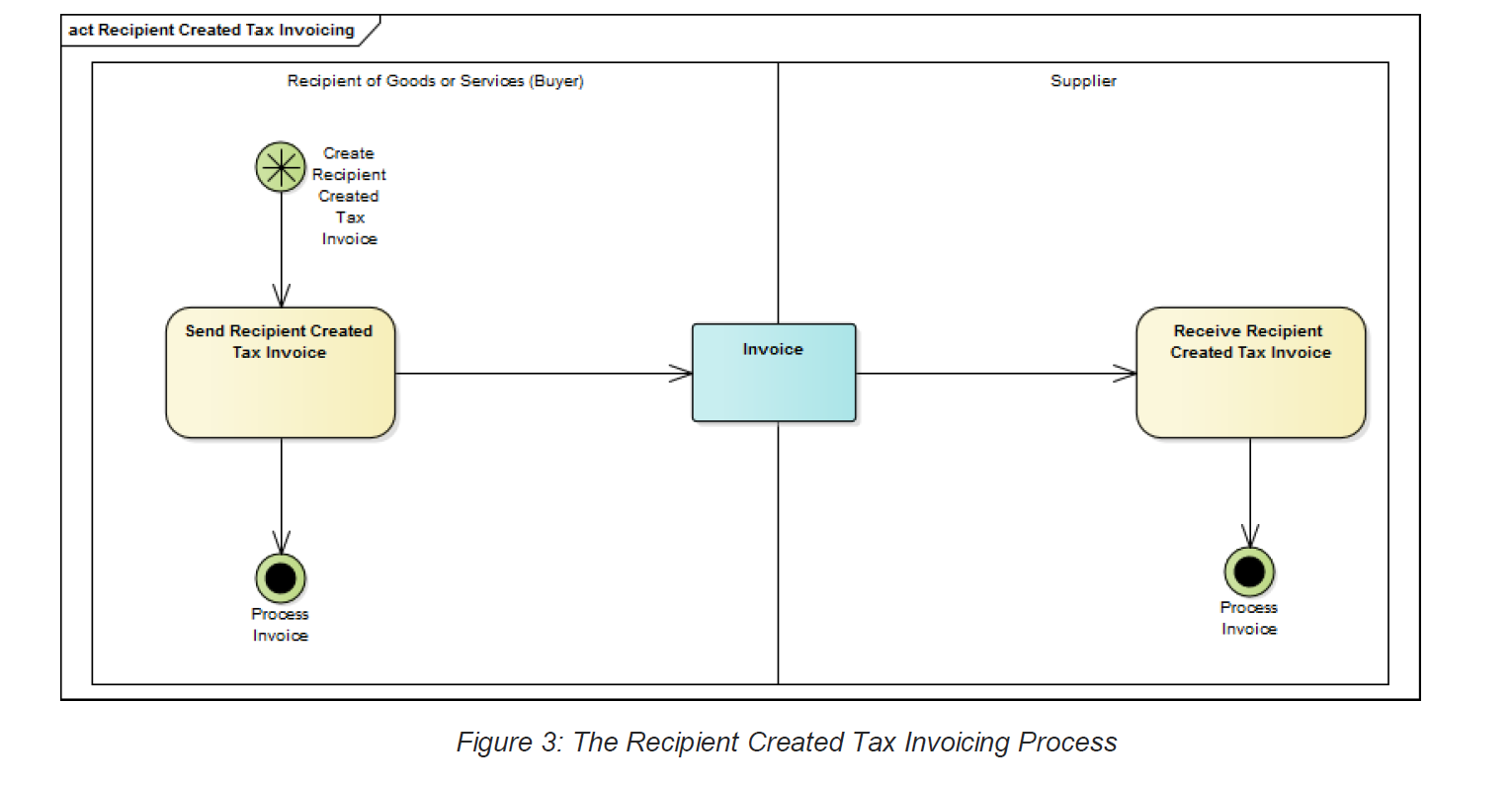

8.1.1 Recipient Created Tax Invoicing (RCTI)

Recipient Created Tax Invoicing is a specialised type of Invoicing process. With Recipient Created Tax Invoicing a Tax Invoice is issued by the Party that receives the goods and services (normally the Buyer), rather than the Supplier (Australian Government, 1999).

For example, a sugar cane farmer and a mill have entered into an agreement that the Buyer will Invoice and provide Payment for a delivery of cane based on the quality of the cane. On a delivery of cane to the mill, the Buyer creates a RCTI.

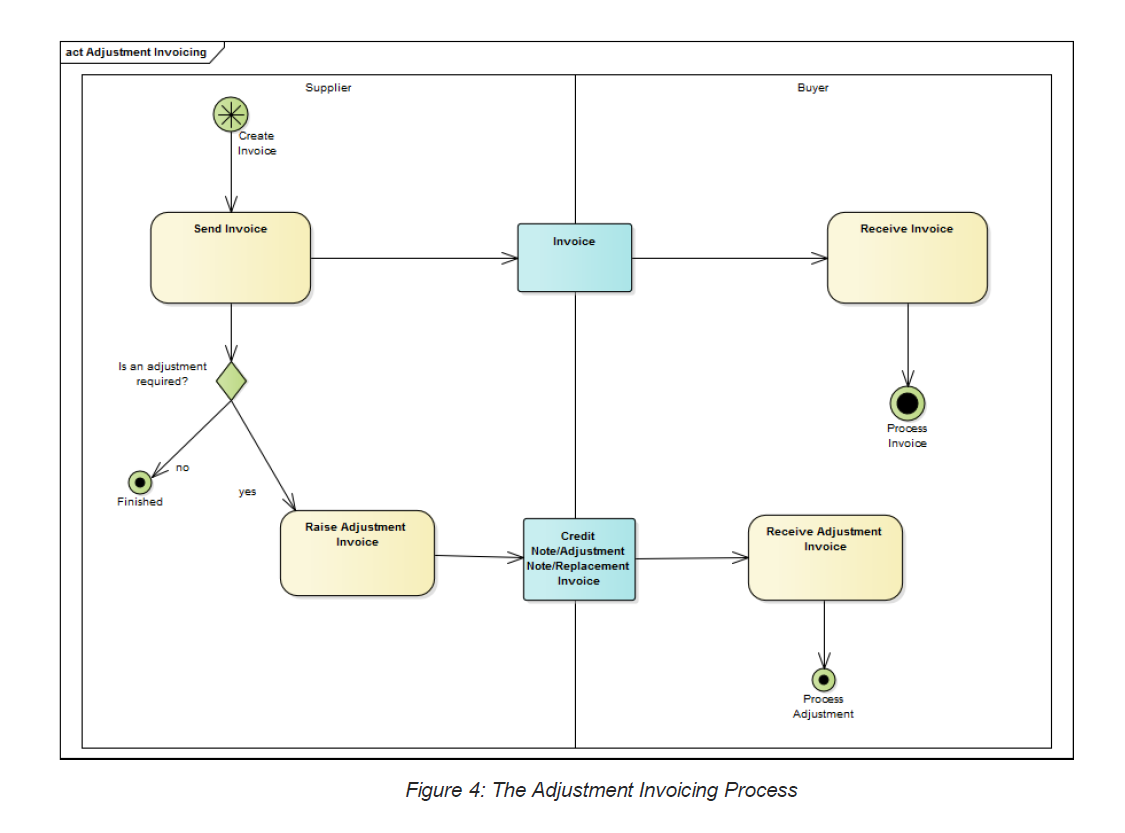

8.2 Adjustment Invoicing

After an Invoice is created, it is sometimes necessary to adjust the information. For example, an adjustment may be needed when:

There is an error in the relevant Invoice, for example it is to the wrong Buyer, at the wrong time or the wrong amount was charged;

The Amount of the original Invoice no longer reflects the amount the Buyer owes, for example due to Items being returned or a dispute about Items provided; or

The supply becomes Taxable or stops being Taxable.

This process is described in Figure 4. The two common processes for adjustment Invoicing are described below.

8.2.1 Credit Notes

The Supplier may create and issue a Credit Note that acts as a ‘negative Invoice’ to offset a previous Invoice.

Credit Notes may also be known as Adjustment Notes for Tax reporting purposes (Australian Government, 1999) and ATO GST ruling GSTR 2013/2 (Australian Government, 2013); and

8.2.2 Copy, Duplicate and Replacement Invoices

After an Invoice has been received, additional versions of the Invoice may be sent:

A copy of the original Invoice may be sent;

A duplicate Invoice may be sent accidentally; and

A replacement Invoice, with different details, may be sent to replace an existing Invoice.

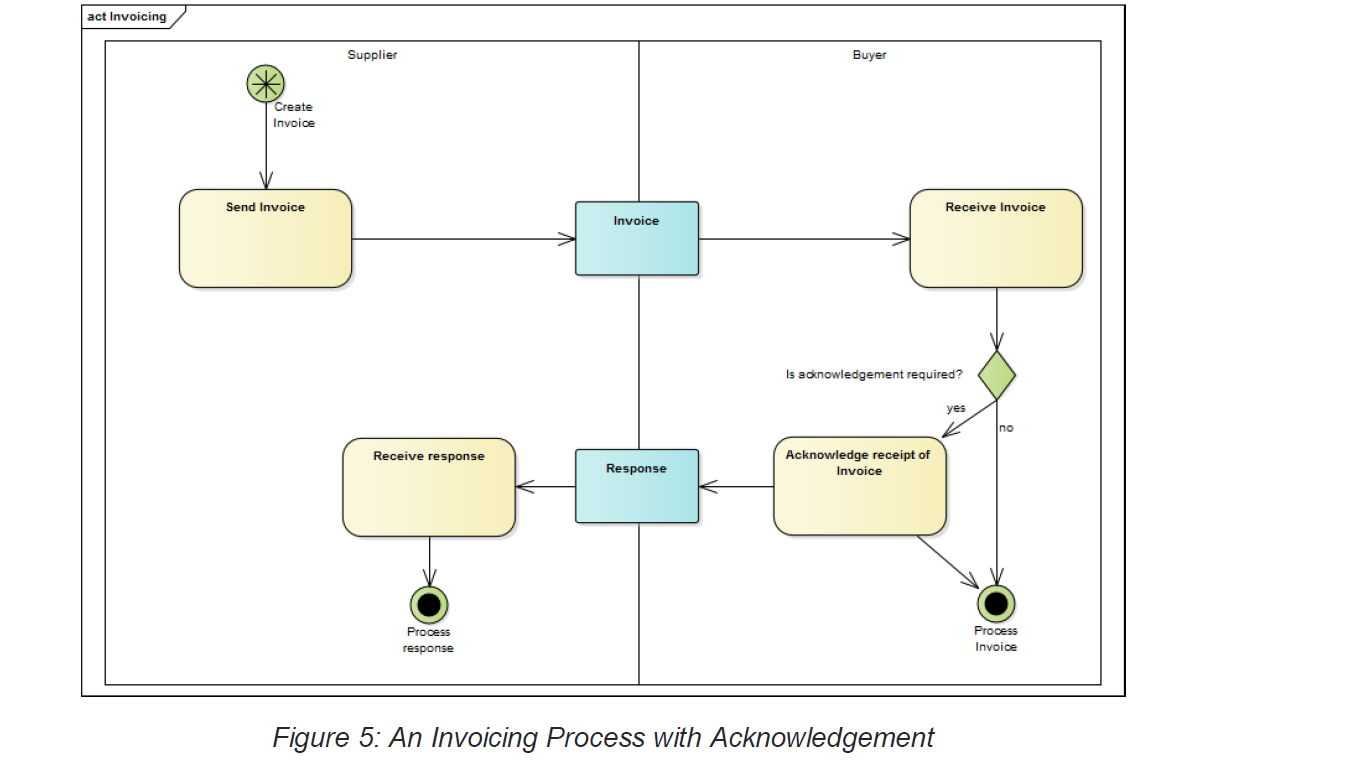

8.3 Acknowledging Invoices

With an eInvoicing process it is not uncommon for the recipient (e.g. Buyer) to respond to the eInvoice by sending an acknowledgement in the form of a Response document. Figure 5 describes the flow of a common eInvoicing process with an acknowledgement.

Responses may also be sent to acknowledge Recipient Created Tax Invoices and adjustment Invoices.

8.4 Business Requirements

An Invoice needs to support a number of related business functions. The eInvoicing Semantic Model supports:

- Tax reporting;

- Conforming to the Goods and Services Tax Act (1999) (Australian Government, 1999).

- Verification;

- Allowing identification of the commercial transaction covered by the Invoice.

-

Matching; and

- Matching against known accounts payable information, such as purchase order numbers.

- Payment;

-

Specifying how payments are to be made.

Other requirements such as international (cross border) Invoicing or Invoice routing within organisations or networks may be considered as Extensions to these Core requirements.

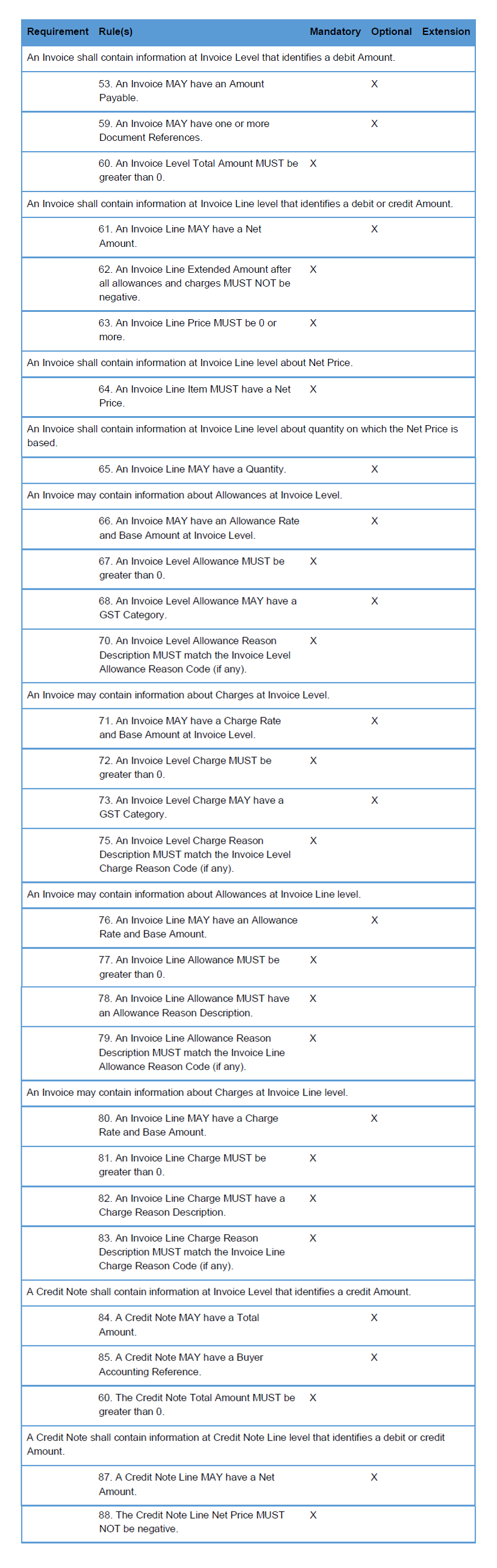

The table below identifies the eInvoicing Semantic Model Core business requirements and the Mandatory and Optional rules that support them. Note that some Extension requirements are also shown to provide examples.

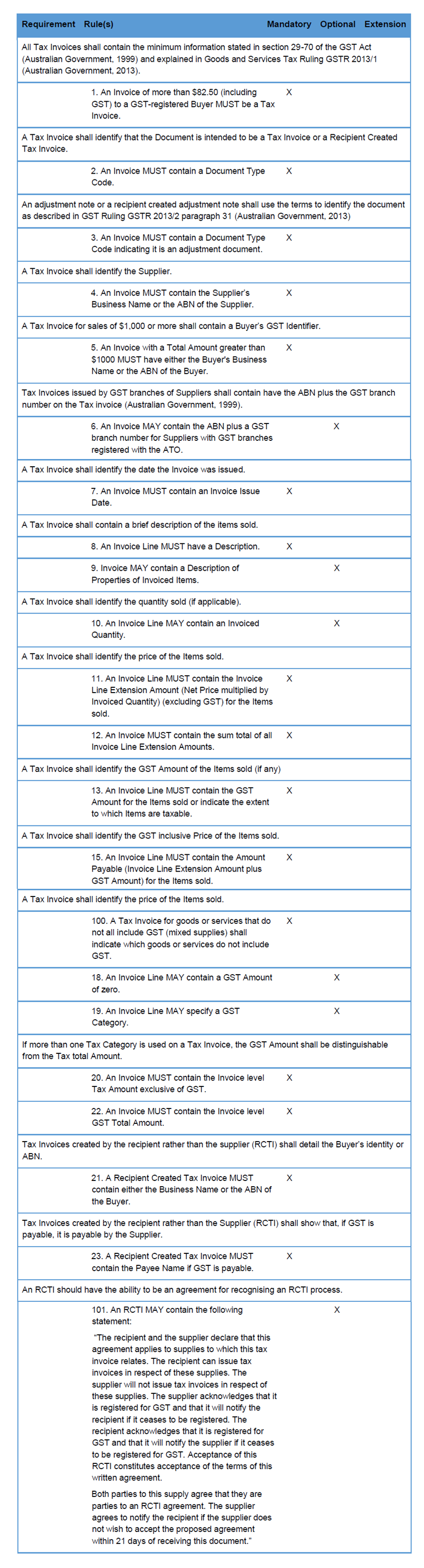

Table3: Core Business Requirements and Rules for Tax Invoices

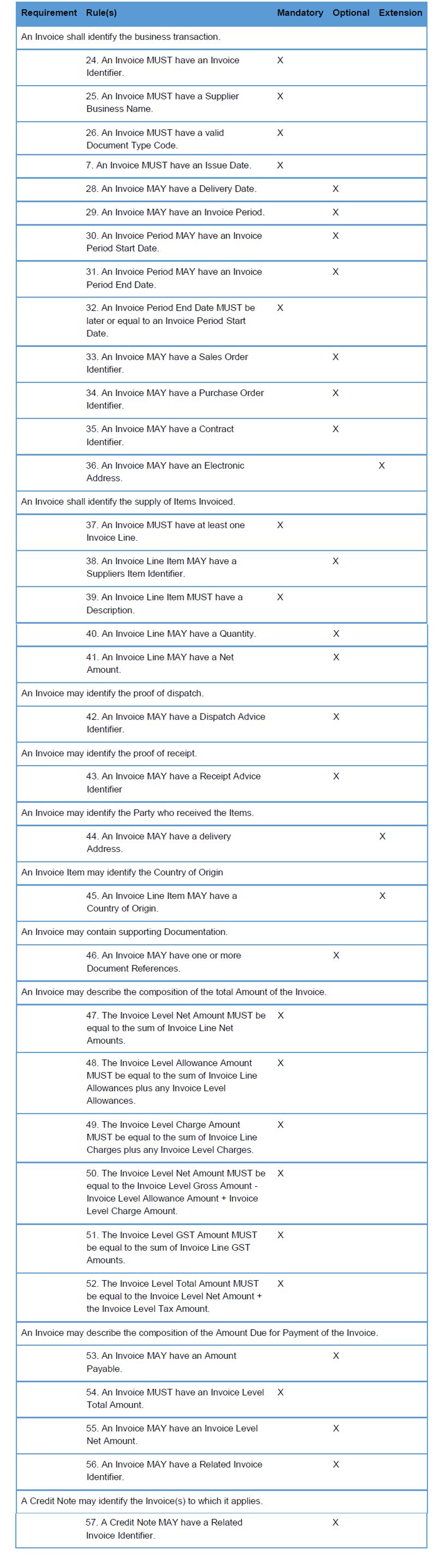

Table 4: Core Business Requirements for Invoice Verification

Table5: Core Business Requirements for Invoice Matching

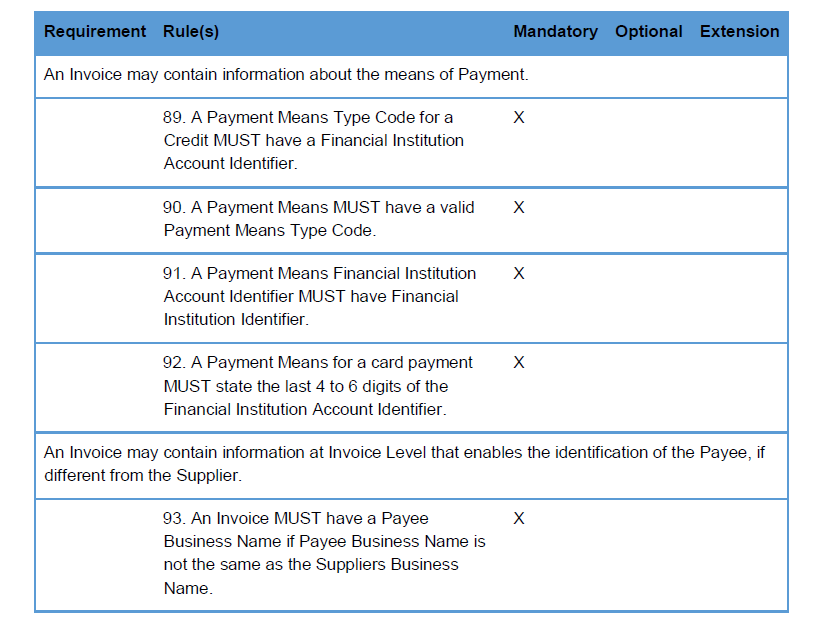

Table 6: Core Business Requirements for Invoice Payment

8.5 Other Procurement Processes

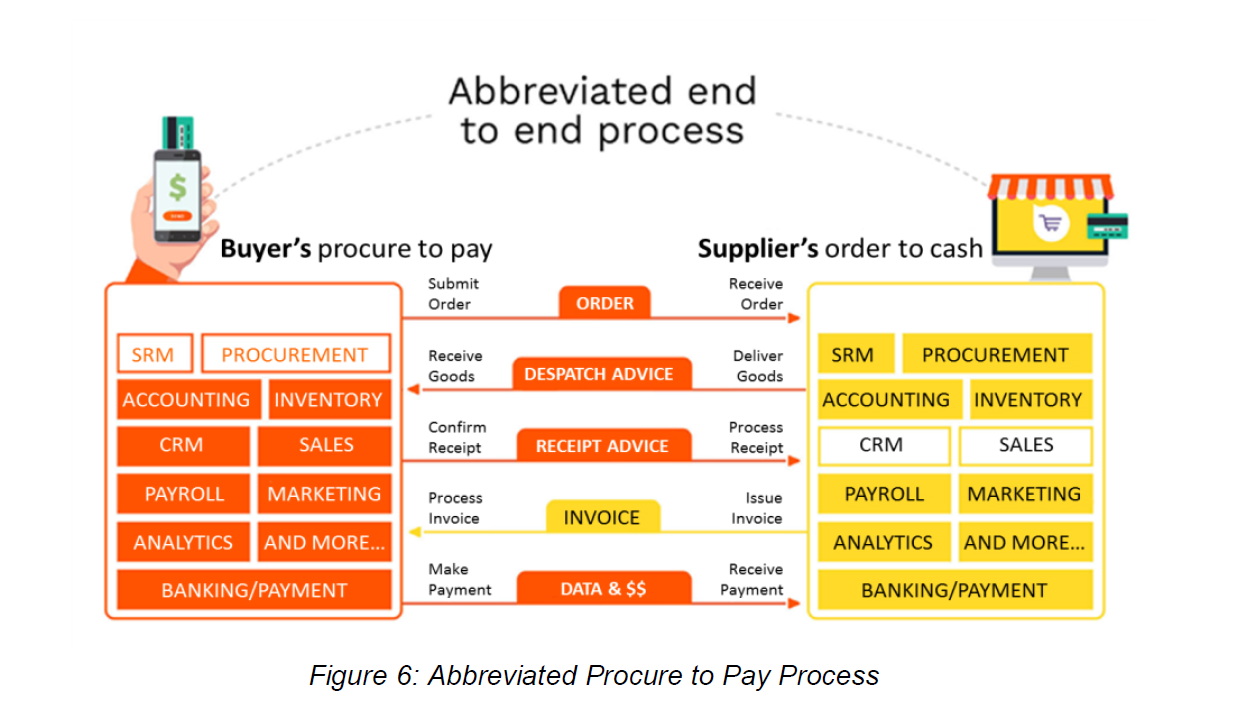

The Procure to Pay processes of Buyers and Suppliers are inextricably linked. Figure 6 shows how Invoicing is one step in this broader process.

It is also recognised that Procure to Pay also forms only one part of the overall set of supply chain processes that includes the financial supply chain (dealing with banking/Payment) and the logistical supply chain (dealing with receipt and delivery of goods). Information flows into and out of these processes and so the eInvoice Semantic Model needs to complement these processes.